- Don’t shop when hungry; it’s harder to resist temptation.

- Watch the cash register ring up items. Count your change. Check the receipt.

- Drink plenty of water.

- Eat 3 – 6 light meals a day.

- Avoid eating out – even fast food.

- Avoid meat – you can get protein through nuts and other food.

- Keep water and mixed nuts in the car so you don’t pull into a restaurant when hungry.

If you’re handy

- Cut your family’s hair with a kit and thinning shears.

- Do home repairs with the help of the net.

- Browse ‘as is’ yards in thrift shops for furniture, appliances, parts, etc.

Where to shop

- Garage sales and swap meets. Sellers take lower offers toward the end of the day.

- Thrift stores – check periodically, the better items don’t last.

- Outlets for ‘day-old’ bread. Freeze it.

- Auctions through the post office, police depts., etc.

- Outlets for ‘seconds’ and ‘imperfects’ in quality clothing.

Cars

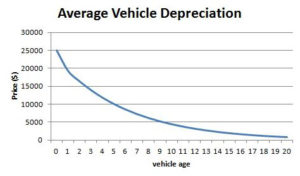

- NEVER ever buy a new car as you lose great amounts of money thru depreciation:

- Never buy a used one without checking its ratings and having your mechanic drive it and list what needs repairing. See the net for this.

- Cars sold ‘as is’ at commercial auctions can be terrible buys. No dealer will touch them.

- Cars owned by the elderly often have low mileage.

- Don’t buy a car that’s been in a wreck. Avoid cars from snowy climates – they have rust.

- Four door cars are generally cheaper and resale better.

- If you repaint, consider white as it doesn’t fade and it’s cooler in summer.

- Practice ‘preventative maintenance’.

- Insurance for older cars is lower. Get parts from a junkyard if your handy.

Legal

- You can often avoid lawyers when you divorce, make a will, sell your house, or file for bankruptcy. If you need one: be clear on fees, be organized, don’t call him much, and don’t use him as a therapist. Online legal services are good for forms but make big mistakes.

- Use mediation, arbitration, and small claims court.

Health

- 10%-30% of doctors visits, medical tests, procedures and surgeries are unnecessary.

- When possible have all tests done in advance on an outpatient basis. Keep copies of the results.

- Treatment in a doctor’s office is the least expensive. It’s more in an outpatient center, and most in the outpatient dept. of a hospital.

- Some immigrant doctors charge less.

- Community hospitals are preferred over teaching hospitals.

- Don’t go into a hospital from Friday afternoon through Sunday, unless it’s an emergency.

- Don’t go to a specialist until you need one.

- Get 2nd opinions before surgery. Many insurance plans will pay for this.

- Carefully check your bill.

- Try free samples of prescribed drugs to test for side effects. Later shop around and buy generic drugs in bulk by mail order.

Owning a house in the US

- Vines on the southern and western walls cut the summer heat.

- Insulating the attic (in southern Calif.) pays for itself in 3-4 years; insulating the walls does in l0 years.

- Turn down the temp. on the water heater. Insulating the tank saves $55/yr. Insulate the pipes.

- Carpet and padding cut down on heat lose.

- To the south of the house plant trees which lose their leaves in winter and shade the house in summer.

- If repainting, consider white – it doesn’t fade. Buying an airless sprayer for jobs like this can pay for itself if you’re handy.

- Put in double paned windows with a high R-value when replacing.

- Buy a carpet machine for rugs, furniture, and car upholstery rather than renting one periodically.

Utilities

- Look for an insulated apt. or house.

- Heavy duty door closers on exterior doors keep the heat inside in winter and out in summer, and prevent slamming by the wind.

- Hook up the clothes washer only to cold water. This saves 90% of the cost of washing. Wash only full loads. Dry only full, consecutive loads. Keep filters clean.

- Low-flow shower heads claim to save up to $90/yr.

- Turn down the water pressure for bathroom and kitchen faucets.

- Use aerators in the faucets.

- Refrigerator. Don’t put it close to a range, dishwasher, or sunlight. Keep the freezing and food compartments full so there is less cold to air to spill out. Keep the food compartment at 37 degrees. Consider a self-closing door.

- Use an electronic thermostat which turns the heat down when you’re sleeping. Close only 1 or 2 vents. Closing more makes the system less efficient.

- An inside/outside thermometer shows when to open and close windows and doors.

- Close inside and outside shades and drapes to keep heat in in winter and the sun out in summer.

- A 220 volt air conditioner (if your house is wired for it) is more efficient than a 110.

- Mount air conditioner in the shade and wind. Close off rooms not being used.

- A whole house fan pumps the hot air out of the house during summer nights and pulls cooler air in through windows. Opposite in winter when it’s warmer outside.

Garden

- Build a compost pile for fertilizer and mulch.

- Plant things you can eat.

- Automatic sprinklers probably pay for themselves. Don’t water during the day.

- A soil sample will show if you need to add elements. They will save water, chemicals, and time.

Misc

- You’re in trouble if over 25% of your take home pay goes to credit cards and personal loans (include your car loan but not mortgage, rent, food and utilities).

- You’re in trouble if three of the following are true:

- you get new loans to pay for old loans

- you don’t know how much you owe

- you charge items because you have no cash

- you borrow to pay for food and utilities

- Your rent or house payments shouldn’t be more than 1/4 of your gross income.

- Pay off credit cards; consider getting rid of them. Cut back on vacations, toll calls, and entertainment.

- Buy off season and in bulk.

- Don’t buy anything on time.

- Don’t gamble.

- No pets, except for security.

- Ready-made glasses.

- Save receipts; send in warranties.

- Don’t be tempted by ‘specials’ and sales unless you have planned for a long time to buy the item.

- Take your lunch to work to save $1000/yr (in ’92).

- Have a certain % of each paycheck automatically put into a savings account.

- Put aside three to six months income for emergencies.

- Save your tax records at least seven years.

- Use CONSUMER REPORTS.

- Search the net for tips and infographics on ‘how to save money’.

- Rent your garage or yard for storage [if the legalities are clear].

- Rent a room in your house.

ttps://www.timelessissues.com/category/law/legal-nightmare-over-rented-room/

https://www.generaladvice.org/renting-rooms-in-your-house/ - Search the net for other tips and ‘microfinance’.

- Make saving a challenge, a game.

awesome, do you mind if I share this?